The government of Pakistan is considering imposing a 30% tax on freelancers in Pakistan 2022 including YouTubers, TikTokers, gamers, and everyone who does online earning.

It also includes those people who earn from gaming and who earn money from all social media platforms.

ARY news which is a mainstream media in Pakistan also confirmed this news on the 6th of June, 2022.

According to the sources, the Pakistan government will accept the condition of the International Monetary Fund (IMF) to reduce the relief in income taxes.

And the government of Pakistan is considering imposing a 30% tax on everyone who earns more than 1 Lac per month online including freelancers.

It will be a huge setback for the IT industry in Pakistan and it will also demotivate so many people who are struggling to earn online.

Because even if we talk about freelancers only, their income already got deducted a lot.

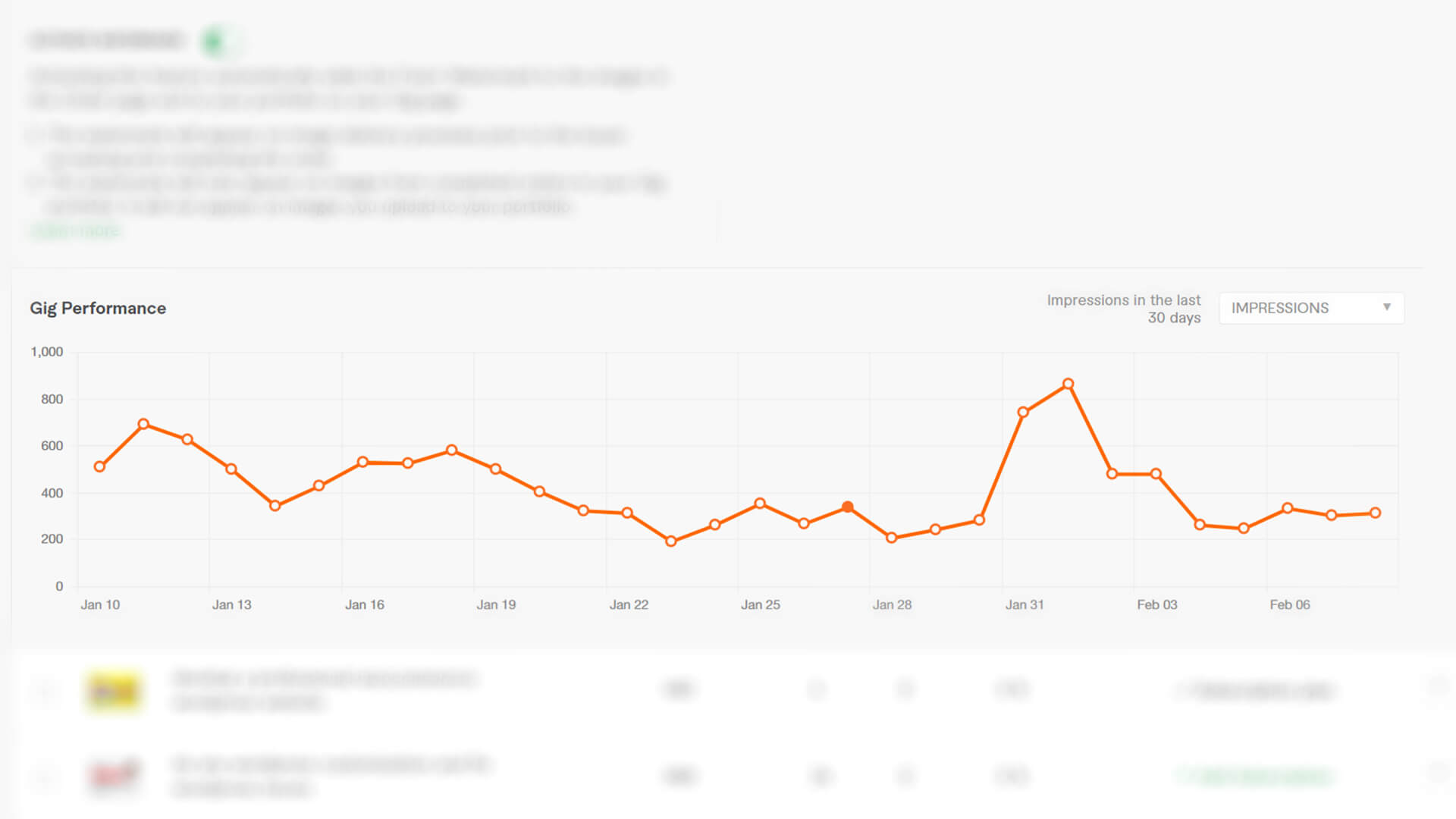

Many freelance platforms deduct a percentage from each order of freelancers. For example, Fiverr is a freelance platform that deducts a 20% amount from each order of a freelancer.

After this deduction, when those freelancers transfer the amount to Payoneer, then they pay an additional $3 amount per transaction.

So, now if the government of Pakistan also imposes a 30% tax on freelancers of Pakistan, they will only get around 50% of what they earn.

The 30% tax on freelancers & online earnings in Pakistan is huge and it will discourage people to earn money online and bring money to Pakistan.

People raised voices against this tax on Twitter and #saveITindustry was on top-trend in Pakistan.

30% Tax on Freelancers in Pakistan 2022 (Update July 2022)

Fortunately, the government did not impose a 30% tax on freelancers in Pakistan. Right now, Prime Minister Imran Khan’s zero tax policy is applied to freelancers. This was the best step for the freelancers by former Prime Minister Imran Khan.

If you are a freelancer and want to get this zero tax policy then there is some procedure that you would have to follow.

You will have to register yourself as a freelancer first in Pakistan Software Export Board.

What if you don’t get registered?

There will be a tax on freelancers in Pakistan 2022 if they are unregistered. If are not an unregistered freelancer then first you will have to see whether you are a filer or a non-filer.

- If you are a filer then all the freelance income that you will receive from freelance platforms to your local bank then your 1% amount will be deducted.

- If you are a non-filer then 2% of your income will get deducted.

But if you get yourself registered as a freelancer then your income will not get deducted and zero tax policy will apply to you.